Make no mistake – recovery is building

Scot-Buzz editor Bill Jamieson is optimistic…

First the firmer tone of business surveys; then official figures; now growth forecast upgrades: economic recovery is continuing to build – and may soon be edging back up to trend growth – for the first time since 2008.

The biggest validation came yesterday when the Paris-based Organisation for Economic Co-operation and Development (OECD) revealed that its leading indicator for the UK climbed to 100.8 in April from 100.7 in February and March.

It’s modest and it’s glacial – but it confirms a definite upward trend. Back in May last year this closely watched indicator stood at 99.4.

Other forecasting groups are now raising their predictions for 203 and beyond.

Meanwhile, latest Purchasing Managers Index (PMI) data from the Bank of Scotland showed a marked improvement in the health of the private sector economy north of the border.

May saw solid and accelerated increases in both output and new work inflows at Scottish businesses, as well as the fastest rise in employment for over a year.

Growth of private sector business activity in Scotland accelerated at the fastest pace since April 2011. This was signalled by the Bank of Scotland PMI posting 54.4, up from 53.1 in April. Both factory production and service sector business activity rose at faster rates, the sharpest in 12 and 13 months respectively. The pace of economic expansion was broadly in line with the average across the UK as a whole.

THE SCOT-BUZZ VIEW

Since we launched this website last summer we have consistently highlighted evidence of recovery – tentative though it was in the early stages.

This evidence has grown in intensity and is setting in across more sectors with every quarter.

We have no illusions about the weakness of this recovery compared with earlier cyclical recoveries. Nor have we glossed-over the deep-seated problems we face – not least the deficit and overall government debt.

This is - and is likely to remain – a weak recovery by historic standards. We do not see growth rising much above 1.5 per cent for the forseeable future – half the rate we grew accustomed to seeing before the global financial crash.

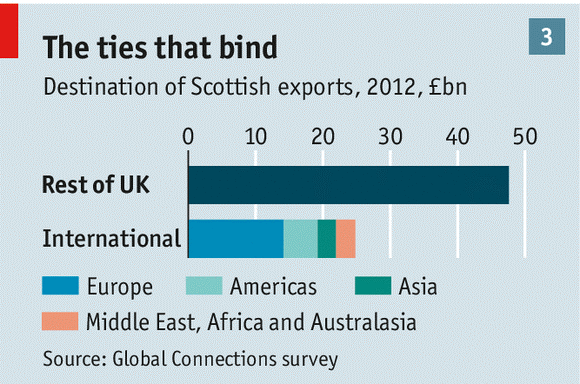

We need to see far stronger supply-side reform to lift productivity and earnings, and to improve our export performance in particular. We are only just out of the woods. But at least we are heading in the right direction.

Behind the overall increase in output north of the border was a further improvement in new work inflows. The level of new business has now increased for six months running.

The OECD indicator provides firm evidence of a spreading recovery across the UK as a whole. It reported that the April reading for its leading UK indicator points to growth close to its trend rate.

UK survey evidence for May has been notably stronger, not only overall but across a wide range of sectors.

As a result, Howard Archer of Global Insight has upgraded his UK GDP forecast for 2013 from 0.8 per cent to 1.0 per cent and for 2014 hem is now predicting growth of 1.6 per cent, up from 1.4 per cent.

Says Dr Archer, “The recent improvement in a wide range of indicators suggest that the UK economy may finally be gradually moving to a firmer footing – and it could be particularly significant that the improvement in the survey evidence for May occurred across a number of areas.”

Recent encouraging pointers include the purchasing managers’ survey for the dominant services sector which hit a 14-month high in May with the new business index at a 39-month high.

The PMI survey for manufacturing showed a second successive month of expansion with activity at a 15-month high while construction activity showed the first growth, albeit modest, since last October.

Consumer confidence rose markedly in May to be at equal highest level for two years. Last week we reported the British Retail Consortium’s survey showed retail sales up 3.4% year-on-year in May.

Car sales climbed 11 per cent year-on-year in May while both the Halifax and the Nationwide reported a moderate increase in house prices.

Says Dr Archer, “The hope is that this will fuel a sustainable improvement in business and consumer confidence, which in turn encourages businesses to invest and employ more, and consumers to spend more.”

Confirmation of an upturn in UK business confidence has come with latest readings of the BDO optimism index showing business confidence is at its highest point since May 2012, pointing to improved business conditions for the rest of 2013.

This index, which predicts business performance two quarters ahead, moved up for the fourth consecutive month, to 93.6 in May from 93.0 in April. BDO’s Output Index, which predicts short-run turnover expectations, also improved in May, to 94.4 from 94.1, an 11-month high. The Output Index for manufacturers showed particular improvement, moving up substantially from 90.8 to 93.7.

And improving confidence is feeding in to businesses’ hiring intentions. The BDO Employment Index, which measures UK businesses’ hiring intentions over the next two quarters, rose to 96.6 in May, the index’s highest since August 2011. This is the fifth consecutive month that the index has been at or above the crucial 95.0 level that represents employment growth.