MAGNIFYING GLASSES AND HUBBLE TELESCOPES AT THE READY…

Tomorrow Chancellor George Osborne, Honorary Life President of the Fingernails Club, gets first sight of critical GDP figures for the first quarter before they go out on general release on Thursday.

For thousands of small firms it won’t matter a jot whether the figure is fractionally on the plus or minus side of growth. The OBR’s March quarterly forecast implied that we will have escaped a triple dip recession with growth of just 0.1 per cent in the opening three months of the year. As a line on a graph it makes a cat’s whisker look gross.

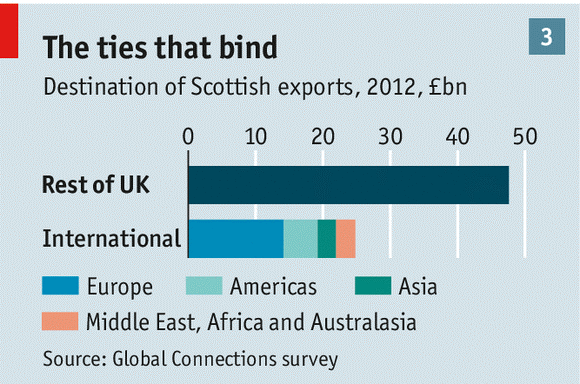

But as we revealed in our splash story here last week, Scotland is bucking the trend, with better performances on employment and economic growth than other regions and nations of the UK.

Our lead story was duly confirmed later last week with official Scottish GDP figures for the final three months of last year showing Scottish GDP grew by 0.5 per cent during the fourth quarter of 2012 and by 0.4 per cent on the fourth quarter of 2011. By contrast, UK GDP fell by 0.3 per cent in the final quarter and grew by just 0.1 per cent on the same quarter a year ago.

Official figures also bore out our consistent coverage of improving employment data for Scotland. Employment in Scotland has seen the largest increase for twelve years with a rise of 39,000 in the three month period to December to February, the largest increase since May-July 2000.

Over the three months December to February 2013 total unemployment fell by 11,000 or 0.5 percentage points to 7.3 per cent – making Scotland’s unemployment rate lower than the UK rate (7.9 per cent). The Scottish youth labour market continued its strong performance of recent months with the youth unemployment rate now down 6.8 percentage points over the year to December to February. The Scottish youth unemployment rate of 16.1 per cent is lower than the UK rate of 20.6 per cent.

There is another theme we have consistently stressed in recent months: the resilience of new business formation.

This has caused us to wonder whether official ONS figures give sufficient weighting to SME data in GDP estimates. We have also called on the Scottish government to provide a StartUp Scotland index tracking new business formation.

Today we draw attention to two further encouraging pointers for the economy here, whatever the miserable UK GDP data may reveal.

The latest Bank of Scotland Labour Market Barometer published this week shows continued improvement in Scottish job market conditions - reflecting the positive trends from this month’s Labour Market statistics. Its composite index for Scotland has increased to 53.0, stronger than that for the UK as a whole which is 52.3.

The strongest rise was for permanent appointments, which more than reversed a reduction in February. Higher placements generally reflected greater demand for staff, but the rates of vacancy growth remained weaker than their respective long-run series averages.

Donald MacRae, Bank of Scotland chief economist said, “This latest Barometer for March shows a welcome rise from the low of last month. The number of people appointed to both permanent and temporary jobs rose while the number of vacancies increased. These results reinforce the view that the Scottish economy is continuing its slow recovery from recession.”

And last week the Scottish government announced an initiative which should deliver a cash flow boost for Scotland’s beleaguered construction industry. It will be trialling project bank accounts for large public sector construction projects. This should result in faster payments to firms.

The Federation of Small Businesses (FSB) welcomed the move, which it recommended to the government earlier this year. Andy Willox, their Scottish Policy Convenor says, “Small sub-contractors working on publicly-funded projects deserve to get paid as quickly as the primary contractor. For too long, big contractors have used small construction companies as a free source of credit.”

None of this is to suggest that we are on a free and clear road to recovery. But there are growing signs that the economy may have passed the worst. Retail sales have held up better than feared. Employment data does not confirm the flat lining of official GDP statistics. Car registrations have been buoyant, and mortgage lending is picking up.

But this is not the stuff of recent headlines. Last Friday ratings agency Fitch became the second to strip the UK of its triple a status, this hard on the heels of news that the IMF had downgraded its growth forecasts for the UK. Its chief economist Olivier Blanchard warned the UK should consider alternatives to its current “austerity” drive. All this as a team from the International Monetary Fund is due to arrive in the UK to begin consultations with the government next month.

Osborne is now set to announce an extension to the Bank of England-run Funding for Lending Scheme (FLS) in the coming weeks.

The key point of the scheme when it was first announced lasts August was that it would boost bank lending to small firms by providing banks with cheap loans on the proviso that they pass them on to customers. But while it may have helped to lower the cost of mortgages, Bank of England figures suggest participating banks were lending less money overall in the second half of 2012 than they were in the previous six months. The scheme is "not a panacea”, says Stephen Pegge of Lloyds.

Nevertheless, the Bank of England’s Monetary Policy Committee said earlier this month that there may be “merit” in an extension. And that view is likely to be strengthened by the arrival of Mark Carney as Bank of England Governor. Separately, another dollop of quantitative easing is widely expected.

Analysis is urgently needed on why the FLS scheme has not performed as well in the first six months as had been hoped. But that is no reason to abandon it after such a short period. It may well not be the panacea the cure-all of some optimistic hopes. But as those GDP numbers will remind us on Thursday, the SME sector still needs all the help it can get.